Stay in touch with latest news

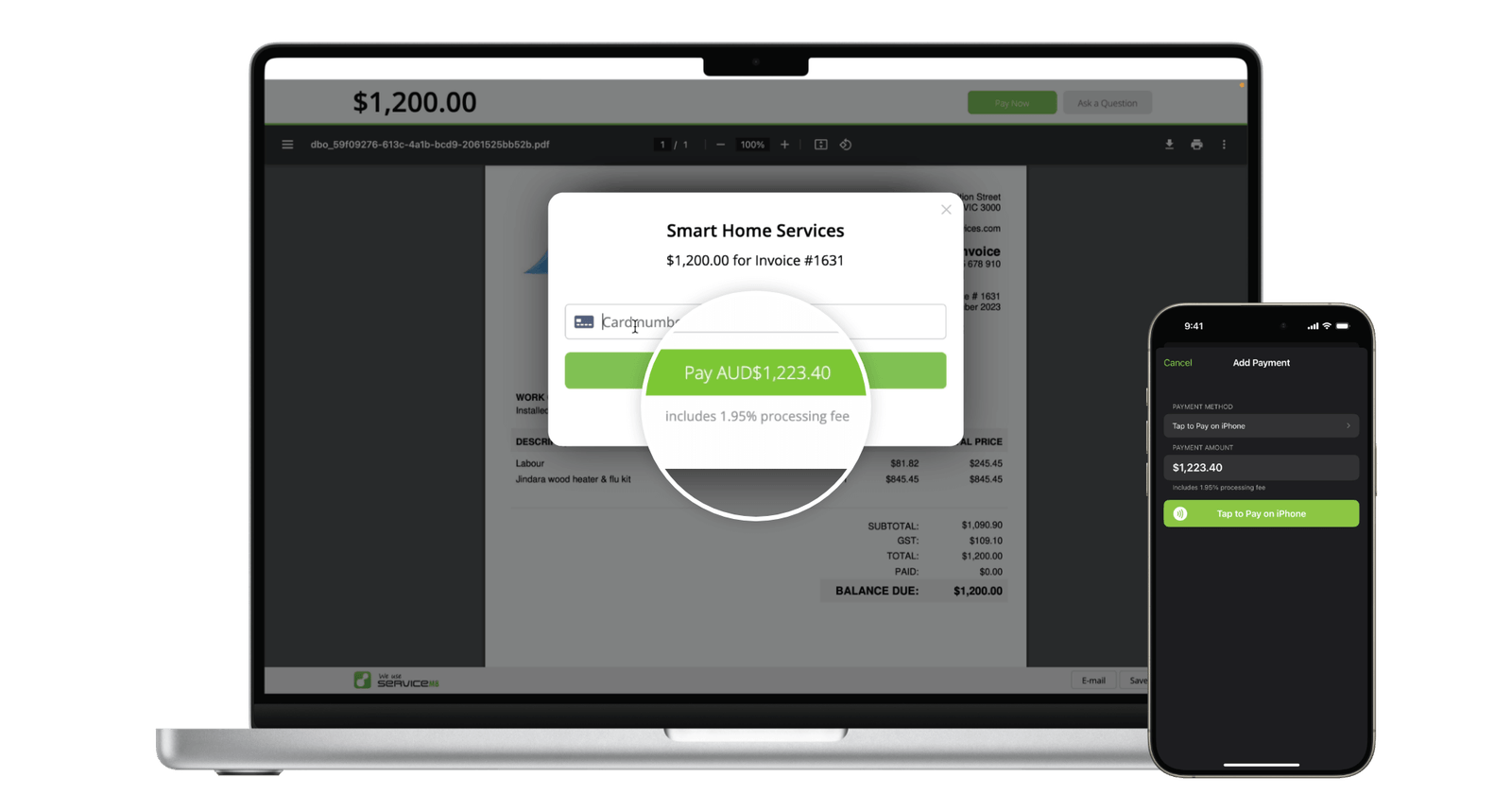

ServiceM8 V12 Update

ServiceM8 V12 New for 2023. Where do we even start? ServiceM8 have out done themselves with new features that will truly save you time and improve the way you run your business. We are outlining only a few of the new features which you will see upon your version...

ServiceM8 Automations

5 Techniques to help with Automation in ServiceM8 Here are a couple of techniques perhaps you could consider to improve your communication with customers. Automations is a passive way to do just that. There are five (5) types of automations you can set to save time...

ServiceM8 Measuring

How to use ServiceM8 Measure ServiceM8 Measure enables you to measure lengths and areas with your iPhone or iPad's camera, using Augmented Reality technology. You can measure out lengths, areas, or multiple areas, and even save your measurements to the job...

JobKeeper Update

Jobkeeper The Federal Government has announced that JobKeeper will be extended to 28 March 2021 subject to the following amendments, we will help you understand what this means for your Business. From 28 September 2020 JobKeeper will operate a tiered wage subsidy...

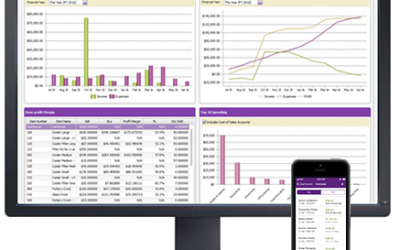

STP Compliance Help

Single Touch Payroll (STP) What is it? Single Touch Payroll (STP) changes the way employers report their employees' tax and super information to us. As of 1st July 2019, all businesses must report STP data to the ATO. Using payroll or accounting software that offers...

Setting up MYOB Bank Feeds

MYOB Bank Feeds MYOB bank feeds let you compare your bank account and credit card transactions with the information you have in AccountRight and easily add transactions. Information from your financial institution is sent straight to AccountRight so you can sort out...

MYOB Inventory

MYOB Inventory A place for everything and everything in its place Any business that needs to count its all it’s widgets, needs to decide whether you'll be using a perpetual or periodical (also known as physical) inventory method. If you already know what you want to...

Website Maintenance

7 tips for end of year website maintenance Make sure your website is backed up and you have a copy saved on your computer to access the files if required due to breaches on your website. This can be completed through your hosting providers back up services or a third...

SBSCH joining ATO Online Services

The Small Business Superannuation Clearing House (SBSCH) will join ATO online services on 26 February 2018 and will no longer be accessible with the current user ID and password authentication. ATO online services gives you access to a range of tax and...

Varies valued clients

Derrick Berends Director John Berends Implents

Derrick Berends Director John Berends Implents